Tax Preparer Resume Example

What does a Tax Preparer do?

A Tax Preparer assists individuals and businesses in accurately preparing and filing tax returns, ensuring compliance with tax laws. They review financial documents, compute taxes owed or refunds due, and use specialized software to complete forms. Typically, they work in accounting firms, tax service companies, or as independent contractors, collaborating with clients and tax authorities.

What are some responsibilities of a Tax Preparer?

The core responsibilities include gathering client financial information, calculating tax liabilities, and preparing tax returns accurately. Tax Preparers ensure compliance with current tax codes and deadlines, offer advice on tax-saving strategies, and resolve discrepancies. They play a key role in preventing errors and audits, contributing to client satisfaction and business reliability.

Tax Preparer Skills for a Resume

Important skills include attention to detail, strong analytical abilities, knowledge of tax laws, proficiency in tax preparation software, effective communication, and confidentiality management.

- Attention to detail

- Analytical thinking

- Effective communication

- Time management

- Problem-solving

- Confidentiality

- Tax code and regulation knowledge

- Tax preparation software proficiency

- Accounting and bookkeeping basics

- Technical proficiency in core tools or software used by a Tax Preparer

- Data analysis and reporting (if applicable)

- Project management and task prioritization (if applicable)

- Industry-specific regulations and compliance knowledge (if applicable)

- Problem-solving and troubleshooting techniques

- Documentation and workflow optimization

- Use of collaboration and communication platforms

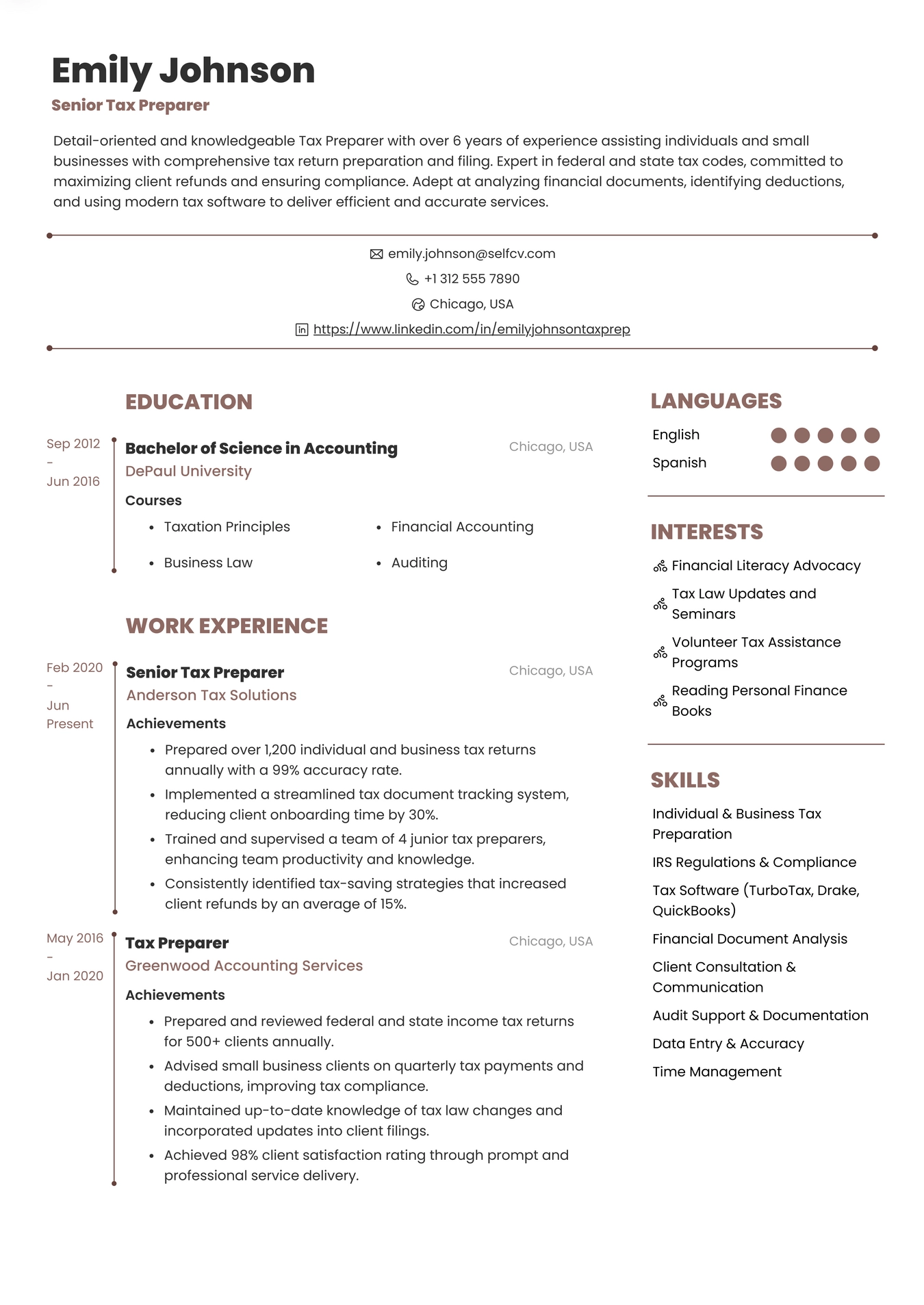

Example Resume for Tax Preparer

Common Mistakes to Avoid When Writing a Tax Preparer Resume

Common mistakes include listing outdated tax software or regulations, using vague job descriptions, neglecting to quantify achievements, failing to tailor the resume to job requirements, and omitting relevant certifications such as IRS PTIN or CPA credentials.

Key Takeaways for a Tax Preparer Resume

A strong Tax Preparer resume emphasizes relevant experience, clear presentation of skills, and measurable achievements. Tailoring the resume to align with specific job postings and including appropriate certifications can significantly improve hiring potential.

- Highlight hands-on experience relevant to the Tax Preparer role.

- Use measurable results to demonstrate achievements and impact.

- Add relevant certifications or completed courses related to Tax Preparer.

- Tailor each resume to the specific job posting.

- Balance technical expertise with communication and teamwork skills.